Summary

U.S. startup failure rates jumped 60% recently due to cash shortages. Your pitch deck presentation is now a survival skill.

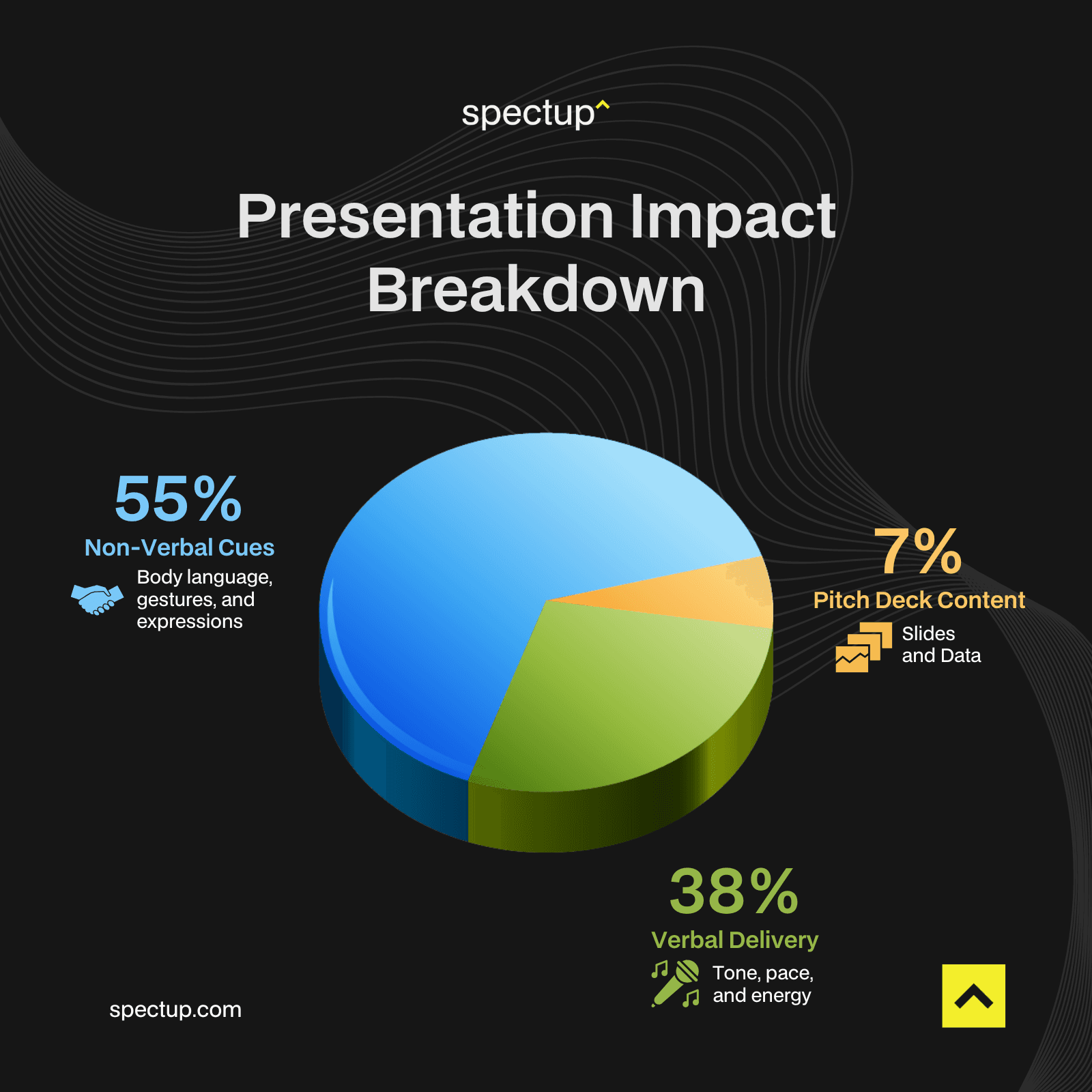

You might not know this but 55% of your impact is non-verbal. 38% is your voice. Only 7% is the actual content of your slides.

TL;DR - Read This:

Pitch deck presentation for startups is less about slides and more about performance. With startup failures up 60% year-over-year, investors are more cautious, your pitch deck presentation needs to cut through noise fast. Key moves that must be followed: Open with a problem story (not company history), practice until you can present pitch deck without reading slides, tailor tone to investor type (VCs want growth metrics, angels want vision), and rehearse on mobile since 40% of investors review decks on phones first. Follow up within 24 hours with requested materials. Master the performance along with pitch deck designs for successful capital raising.

Think of it as a compact version of your story, one that can fit into a few well-crafted slides. You're not just presenting pitch deck slides. You're auditioning for a $5M partnership.

Investors see 200+ decks per quarter. They're numb to "innovative solutions" and "disruptive technology." Your pitch deck slides won't save you if your delivery is flat.

The market reality moving forward for fundraising:

Investors are pickier than ever when observing pitch deck presentation

55% of your impact comes from body language, how you stand, gesture, move

Your tone, pace, energy, pauses hold more weigh than anything.

This isn't a TED Talk. This isn't a product demo.

Pitch deck presentation is a high-stakes sales performance where you're the product.

What changed in Pitch Deck Presentation Trends:

Investors expect mobile-first decks

(40% review on phones first)Virtual pitches are permanent,

Zoom delivery skills are non-negotiableAI pre-screening means your deck gets filtered before human eyes see it

Follow-up speed matters

24-hour response time is the new standard

The mistake most founders make: They perfect their slides and wing the delivery.

Wrong.

Your deck is your script. Your presentation is your movie.

Nobody funds a script.

They fund a performance they believe in.

Understanding What You're Actually Trying to Do while Presenting Pitch Decks:

What a Pitch Deck Actually Is (And Isn't)

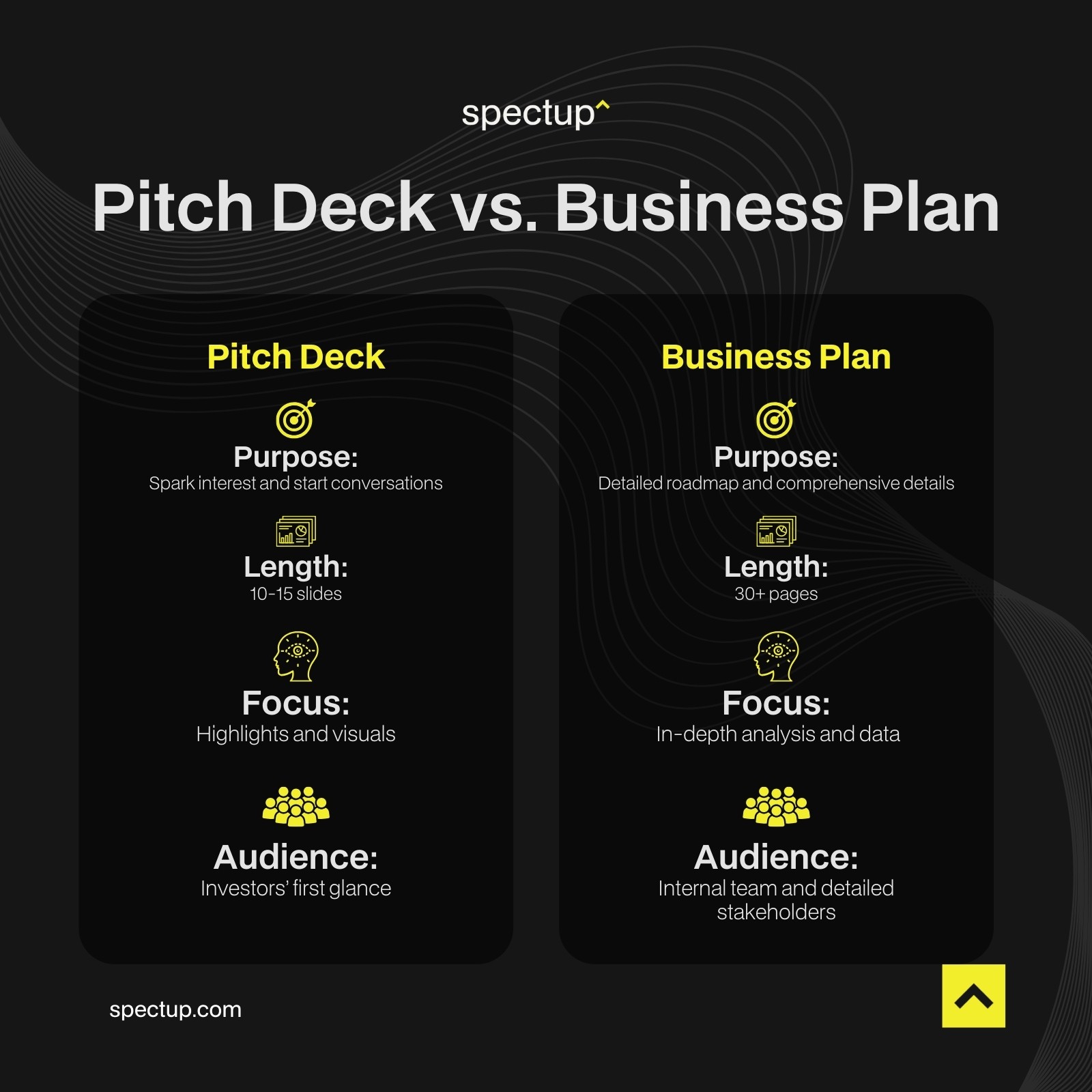

It's not a business plan.

Business plans are 40-page documents nobody reads.

It's a conversation starter.

Think movie trailer.

No one has got time for a whole documentary.

What your Pitch Deck needs to do:

Hook attention in 30 seconds (problem → why it matters → why you)

Prove you understand the market better than anyone else in the room

Show traction that validates your assumptions

Make investors want to ask questions (not try to escape)

The format for Pitch Deck Presentation:

Presenting decks (visual, minimal text, designed for live pitch)

Reading decks (text-heavy, vertical scroll, sent async for review)

Know which one you're building. Most founders need both.

Your Goal Isn't "Yes", It's "Next Steps" in Pitch Deck Presentation

Investors rarely commit in the room. Even if they love it.

Your actual goal when presenting pitch deck:

Get a follow-up meeting (decision-maker, not junior associate)

Spark enough curiosity they want your financials

Avoid obvious red flags that get you archived

Think of it like dating. First date isn't about marriage, it's about getting a second date.

Don't oversell. Don't beg.

Show value, create intrigue, let them chase.

Tailor your Pitch Deck to Your Audience

(Or Waste Everyone's Time)

Venture Capitals and Angel Investors care about different things.

Investor Type: | What They Care About | How to Present Pitch Deck to Them |

|---|---|---|

Venture Capital Firms | Market size, scalability, exit potential | Lead with TAM/SAM/SOM, show 10x growth trajectory, emphasize team's ability to scale |

Angel Investors | Vision, founder story, personal connection | Open with why you started, share founder journey, make it about impact + returns |

Corporate VCs | Strategic fit, partnership potential | Show how you complement their portfolio, emphasize synergies |

Accelerators | Coachability, execution speed | Highlight what you've learned from failures, show rapid iteration |

Do your homework.

Check their portfolio.

Reference their investments.

Show you're not mass-pitching.

"I saw you invested in [Company X], which validates the [Market] thesis we're pursuing..."

That one sentence tells them you're strategic. Not desperate.

Preparing to Present a Pitch Deck (The Work Before the Work)

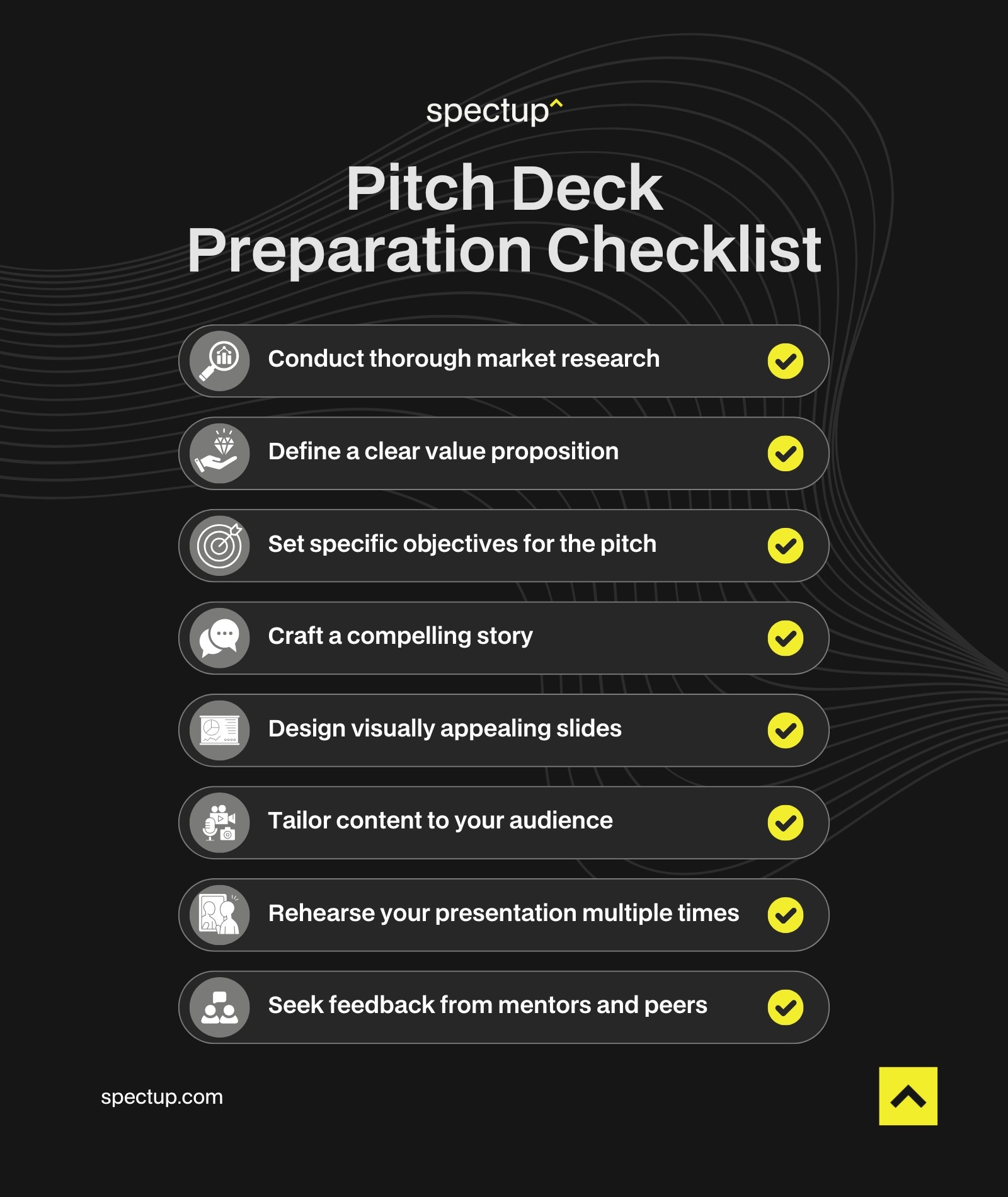

Research Your Investors Like You'd Stalk a Co-Founder

Before you present pitch deck to anyone, know:

What stage do they invest in?

(Don't pitch Series A to a pre-seed fund)What's their typical check size?

(Don't ask for $500K from a $10M+ fund)What industries do they focus on?

(SaaS? FinTech? Climate?)Who in their portfolio is adjacent to you?

(Competitive? Complementary?)

Tools to use for pitch deck presentation:

Crunchbase (portfolio analysis)

spectup (For Pitch Deck Design Services)

Their blog/Twitter (investment thesis)

LinkedIn (warm intros through mutual connections)

Pro tip: Find their rejected companies. Figure out why. Don't make the same mistakes.

Define Your Value Prop (Without Buzzwords)

Bad value prop: "We're an AI-powered platform disrupting the future of work."

Good value prop: "We cut sales onboarding time from 90 days to 14 days using AI role-play. Companies save $47K per rep."

If a 12-year-old doesn't understand it, rewrite it.

Remove:

"Innovative" (everyone says this)

"Revolutionary" (prove it, don't claim it)

"Synergy" (please, just stop)

Add:

Numbers (specific outcomes)

Time saved or money made

Who it's for (ICP clarity)

Set Clear Objectives (Know Your Ask)

Don't walk into a pitch not knowing what you want.

Possible objectives when presenting a pitch deck:

Seed funding: $500K at $5M valuation

Intro meeting: With their partner who specializes in your space

Feedback: Honest take on market positioning

Warm intro: To a later-stage fund in their network

Be explicit. "We're raising $2M on a $10M cap. We have $1.2M committed and are looking to close the round in 30 days."

Clarity speaks of seriousness.

While, Vagueness is equivalent to being Amateur.

Crafting the Story (What Actually Hooks Investors)

Humans are wired for stories, since ages.

Opening with data: "The global logistics market is $9.6 trillion, growing at 5.2% CAGR..."

Result: Investors check their email.

Opening with a story: "Three years ago, my co-founder's e-commerce business lost $80K because a shipment sat in the wrong warehouse for 47 days. Nobody could tell him where it was. That's the problem we're solving."

Result: Investors lean in.

Stories create emotional connection. Data validates it afterward.

The Structure That Works while Presenting Pitch Deck:

The formula that captures attention is Problem → Solution → Proof.

The best pitch arc when presenting a pitch deck:

Problem (something broken that costs real money)

Why now (why hasn't this been solved already?)

Solution (your product/service, simply explained)

Market (is it big enough to matter?)

Traction (proof people actually want this)

Business model (how you make money)

Team (why you're the ones to build this)

Ask (what you need to hit next milestones)

Keep it linear.

Don't jump around.

Each slide builds on the last.

Make It Memorable (The Sticky Moments)

Investors will forget 90% of what you say.

Make sure they remember the right 10%.

Techniques:

Analogies: "We're Stripe for construction payments"

Visuals: Show don't tell (demo video > feature list)

Surprises: Unexpected data that challenges assumptions

Repetition: Restate your value prop 3 times in different ways

Example: Airbnb's original pitch didn't just say "short-term rentals."

They showed real listings, real bookings, real revenue. Made it tangible.

And if you are still unaware of what to do, partner with us for pitch deck design services.

The Essential Slides in Pitch Deck Design (What You Actually Need)

1. Title Slide (Make a First Impression in 3 Seconds)

Here is what they must include:

Company name + logo

One-sentence tagline (what you do, for whom)

Your name + title

Contact info

Example: "Acme Logistics - Same-day shipping for Shopify stores | Jane Doe, CEO | jane@acme.com"

DocSend found that startups with clear, engaging title slides are 2.5x more likely to secure funding.

2. Problem Slide (The Single Most Important Slide)

This is where you win or lose the room.

Bad problem slide: "Supply chains are inefficient."

Good problem slide: "E-commerce brands lose 18% of revenue to delayed shipments. We surveyed 300 Shopify merchants. 47% said shipping delays cost them repeat customers."

Make the pain visceral.

Use numbers.

Use quotes from customers.

Make investors feel the problem.

Structuring Your Narrative

The best stories don’t start with the hero winning; instead they start with a problem. In your pitch, kick off by setting up the problem slide:

Describe the issue your product or service addresses in a way that hits home.

Investors need to see that you’re tackling something real.

Startups calls the Problem Slide the "single most important slide" in any winning pitch deck. Then, bring in the hero: your solution. Show how your product or service can solve this issue, adding clarity and purpose to your pitch.

3. Solution Slide (Show, Don't Tell)

Don't list features.

Show the outcome.

Bad: "Our platform uses AI and machine learning to optimize routes."

Good: "Merchants using our platform cut shipping time by 40% and reduce costs by $12 per order. Here's how:" [Show product screenshot or demo]

Pro tip: Embed a 30-second Loom demo in your slide. Let the product speak for itself.

4. Market Opportunity (Prove It's Big Enough)

Investors need to see a path to $100M+ revenue.

The framework:

TAM (Total Addressable Market) - The entire universe

SAM (Serviceable Available Market) - Who you can realistically reach

SOM (Serviceable Obtainable Market) - Who you'll capture in 3-5 years

Example: "TAM: $175B global logistics tech market. SAM: $8B US e-commerce logistics. SOM: $400M mid-market Shopify brands."

Back it with sources. Cite Gartner, Statista, credible research.

5. Business Model (How You Make Money)

Investors want to know: Can this scale profitably?

Include:

Revenue streams (subscriptions, transaction fees, licensing)

Pricing model (per user, per transaction, tiered)

Unit economics (CAC, LTV, gross margin)

Example: "SaaS model: $99/month base + $0.50 per shipment. Average customer: 2,000 shipments/month = $1,099 MRR. CAC: $450. LTV: $13K. Payback: 5 months."

Clear math = investor confidence.

6. Traction Slide (Proof You're Not Delusional)

This is where you prove people want what you're building.

What counts as traction:

Revenue growth (MRR, ARR)

User growth (active users, signups)

Engagement (DAU/MAU, retention cohorts)

Partnerships (logos of brands using you)

Press mentions (credible media coverage)

42% of investors say traction is the #1 factor in their investment decision (First Round Capital).

Show a graph.

Up and to the right wins.

7. Competition Slide (Know Your Enemies)

Skipping this makes investors think you're naive.

The 2x2 matrix approach:

X-axis: Price (low to high)

Y-axis: Speed (slow to fast)

Plot competitors in quadrants

Show where you sit (ideally in an underserved quadrant)

Then explain your moat. Why can't they copy you in 6 months?

8. Team Slide (Investors Bet on Jockeys, Not Horses)

44% of investors prioritize team as the main factor in investment decisions.

What to include:

Key team members (Founder/CEO, CTO, VP Sales)

Relevant experience (previous exits, domain expertise)

Why this team is uniquely positioned to win

Example: "Jane Doe (CEO): 10 years at Amazon Logistics, scaled last-mile delivery to 50 cities. John Smith (CTO): Ex-Uber engineer, built dispatch systems for 1M+ daily rides."

Show you're not just smart, show you've done this before.

9. Financial Projections (Be Ambitious but Not Delusional)

Investors expect 3-5 year projections.

Include:

Revenue projections (realistic growth trajectory)

Key expenses (headcount, marketing, infrastructure)

Path to profitability (when do you break even?)

Format: Simple table or graph. Don't overload with detail.

If you're projecting $50M ARR in year 3 with 2 customers today, explain the growth assumption.

10. The Ask (What You Need + Why)

Be specific. Be clear. Be confident.

Bad ask: "We're looking to raise some capital."

Good ask: "We're raising $2M to:

Hire 5 engineers ($800K)

Scale marketing ($700K)

Expand to 3 new verticals ($500K)

This gets us to $5M ARR in 18 months and sets us up for Series A."

Show the milestones this money unlocks.

Exit Strategy

Investors want to know how they’ll get their returns.

Discuss potential exit strategies like acquisition or IPO.

It shows you’re thinking long-term about the company’s future and their investment.

Designing for Impact (Presentation Slides That Work)

Visual Consistency (Make It Look Professional)

84% of presentations work better when visuals are consistent (Venngage).

Rules:

One font family (max 2 weights: regular + bold)

One color palette (2-3 colors max)

Consistent slide layout (headers same size/position)

High-quality images (no pixelated screenshots)

Tools:

Pitch.com (templates)

Figma (custom design)

Canva (quick polish)

Or hire a pro like. spectup offers pitch deck design service that make you look funded before you're funded.

Balance Text and Visuals in Pitch Decks (Less Reading, More Seeing)

Rule of thumb: If you're reading your slides word-for-word, you failed.

Good slides:

One idea per slide

Headlines that tell the story (even without you speaking)

Visuals that reinforce the point (charts, product screenshots, customer logos)

Bad slides:

Paragraphs of text

Tiny fonts

Cluttered layouts

Forbes found that using visuals increases engagement by 40%. Use them.

Mobile-First Design (40% of Investors Review on Phones)

Your slides need to work on a 6-inch screen.

Check:

Font size (18pt minimum)

Image clarity (high res, not blurry when zoomed)

Contrast (readable in bright light)

For this, you should:

Open your deck on your phone.

Can you read every slide without zooming? If not, redesign.

Mastering the Performance (How to Actually Present Pitch Deck in 2026)

Practice your Pitch Deck Presentation Until You Don't Need to Think

You should be able to present pitch deck in your sleep.

How to practice:

Record yourself on video (watch for filler words, nervous habits)

Present to friends/mentors (get honest feedback)

Time yourself (stay within your slot, usually 10-15 minutes)

Time to Market says rehearsing helps you refine and build confidence that wins rooms.

The goal: Internalize the story so you can adjust on the fly based on investor reactions.

Body Language That Projects Confidence

Remember: 55% of your impact is non-verbal.

Do:

Stand tall (shoulders back, chest open)

Use open gestures (palms up, arms wide)

Maintain eye contact (connect with each person)

Move with purpose (don't pace nervously)

Don't:

Cross arms (looks defensive)

Fidget (plays with pen, adjusts clothes)

Look at your feet (breaks connection)

Stand behind a podium (creates barrier)

Think of it like conducting an orchestra. Your gestures guide the audience's attention.

Voice Control (38% of Impact Comes From How You Sound)

Monotone = sleep.

Varied tone = engaged.

Techniques:

Pace variation: Speed up for excitement, slow down for emphasis

Volume control: Lower voice for intimate moments, raise for key points

Strategic pauses: Let important statements land before moving on

Energy: Match enthusiasm to content (problem = serious, solution = excited)

Practice recording yourself. Listen back.

Are you interesting to listen to? If not, work on it.

Handle Nerves (Everyone Gets Them)

Even experienced founders get nervous presenting a pitch deck.

How to manage:

Deep breathing before you start

(4 counts in, 6 counts out)Positive visualization

(imagine a successful pitch)Channel nervous energy into enthusiasm

(anxiety ≈ excitement, physiologically)Remember they want you to succeed

(investors are looking for wins)

Carmine Gallo says:

"The most confident presenters are just the best at hiding their nerves."

Use Your Pitch Deck Slides as a Guide, Not a Script

Amateur move: Reading slides verbatim.

Pro move: Slides show the headline, you tell the story.

Example:

Slide headline: "47% of Shopify merchants lose customers due to shipping delays"

What you say: "We surveyed 300 e-commerce brands last quarter. Nearly half told us the same thing: delayed shipments cost them repeat business. One founder said she lost a $40K annual customer because one order arrived 3 days late. That's the problem we're solving."

See the difference?

Slide = fact.

You are the story behind the fact.

Read the Room (Adjust in Real-Time)

Pay attention to body language and reactions.

Signs they're engaged:

Leaning forward

Taking notes

Nodding

Asking questions

Signs you're losing them:

Checking phones

Side conversations

Blank stares

Crossing arms

If you're losing them: Speed up, skip detail slides, jump to traction or ask "What would be most valuable to dive into?"

Flexibility would always outpace rigidness in rooms.

To leave no room for rejection, partner with us for capital advisory and we will help you craft exceptional storyline.

Common Mistakes That Kill Your Pitch Deck Presentation

Mistake 1: Overloading Slides with Information

Cognitive overload can turn into instant tune-out.

Fix this by:

One idea per slide.

Use appendix for detail.

Mistake 2: Ignoring the Competition

Investors think: "They don't know their market."

You should cater this by:

Including competition slide.

Show why you win.

Mistake 3: Lack of Passion

Harvard Business Review highlights:

Passionate founders are 30% more likely to get funded.

You should show Investors that You are definitely here for Capital but alongside that, Show

Why you care.

It's a mission.

Mistake 4: Not Knowing Your Numbers

82% of investors find accurate financials crucial (Forbes).

Before going to pitch your presentation:

Know CAC

LTV

Burn rate

Runway by heart.

No "I'll get back to you on that."

If you are struggling in these, hire partners like spectup without any delay.

Mistake 5: No Follow-Up

80% of investors appreciate prompt follow-ups (HubSpot).

Within 24 hours, send:

Thank you email

Requested materials (financials, customer references)

Next steps proposal

After You Present Pitch Deck: The Follow-Up That Closes

24-Hour Rule (Strike While Iron's Hot)

Investors see multiple pitches per day. You need to stay top-of-mind.

What to send:

Personalized thank you

(Reference something specific from the meeting)Requested documents

(Data room link, detailed financials)One-pager recap

(Key metrics, the ask, next steps)

Followup Template after Presenting Pitch Deck:

"Hi [Name],

Thanks for taking the time today. Per your request, here's our detailed financial model and customer reference list.

Quick recap: We're raising $2M to hit $5M ARR in 18 months. We have $1.2M committed and are closing the round in 30 days.

Happy to answer any follow-up questions. What are the next steps from your side?

Best,

[Your name]"

Provide Requested Info Immediately

Delays signal disorganization or hiding something.

Common requests after presenting pitch deck to investors:

Financial model (Excel with assumptions documented)

Customer references (3-5 referenceable customers)

Cap table (current ownership structure)

Product roadmap (what you're building next)

Have these ready before you pitch.

Don't scramble afterward.

If you are having cognitive overload yourself, make sure to have financial modeling consultant sort out these for you in time, so you may close the deal impactfully.

Stay in Touch (Even If It's a No)

Most investors pass. That's fine.

Maintain the relationship.

Why:

They might invest in your next round

They might introduce you to other investors

They might become customers or advisors

How:

Monthly investor updates (brief email with metrics + wins)

Invite them to product launches or milestones

Ask for advice occasionally (flattery + free consulting)

spectup specializes in fundraising consultancy services and can help you manage investor relations and deal flow systematically.

Learn from Winners (Study Successful Pitches)

Airbnb's pitch deck is legendary. Why?

Clear problem (expensive hotels, impersonal experience)

Simple solution (rent someone's home)

Proof (real bookings, real revenue)

Vision (belong anywhere)

Uber's pitch deck focused on market size and unit economics.

Numbers-driven, data-heavy.

Lessons:

Tailor style to your business (consumer = emotion, B2B = metrics)

Show proof, don't just tell

Back claims with evidence

Download and study these. Understand why they worked.

Presenting a pitch deck is a performance art.

Present pitch deck like you're already CEO of a $100M company. Confidence, clarity, conviction. Investors don't just fund ideas. They fund founders they believe in.

Need help refining your pitch deck and presentation strategy? spectup combines pitch deck services with fundraising consultancy to help you present pitch deck with the confidence and polish that closes rounds. From narrative architecture to delivery coaching, we turn founders into fund-closers.

Let's make your next pitch deck the one that gets wired.

Niclas Schlopsna

Partner

Ex-banker, drove scale at N26, launched new ventures at Deloitte, and built from scratch across three startup ecosystems.