Summary

A recent survey revealed that 83% of respondents believe a good startup advisor or advisory board add value, while 17% see them as a waste of time or equity. As a founder, you might wonder what advisors do, how they help, and how to find and pay the right ones. This article answers those questions.

Key Takeaways

Advisors provide expertise, connections, tailored advice, strategic planning, and objective perspectives for success.

Find startup advisors at networking events, through partners, cold emailing, online communities, or mentorship platforms.

Pay startup advisors via hourly rates, retainers, equity stakes, or a mix. Use advisory agreements to outline responsibilities, compensation, confidentiality, and termination. Keep terms clear for smooth collaboration.

Building a startup isn’t always smooth sailing. You’ll hit bumps early on, so bringing in advisors is crucial for fresh perspectives.

Looking for angel investors to kickstart your startup? spectup connects you with investors, providing expert guidance and resources to secure the perfect funding partner.

What is a Startup Advisor?

A startup advisor is like a mentor for new businesses, helping them get on the right foot. These advisors often have deep industry knowledge, having been startup founders themselves.

“It’s the person you need at the end of the phone when you have the most ridiculous question — which, trust me, there are a lot,”

Ryan Edwards, founder of Audoo, a music tech company

With their good startup advisory, they share valuable connections and lessons from past successes. Like a roadmap, they guide founders, helping them avoid common mistakes.

In fact, 90% of startups fail without the right support. By leaning on advisors with real-world experience, startups can increase their chances of success.

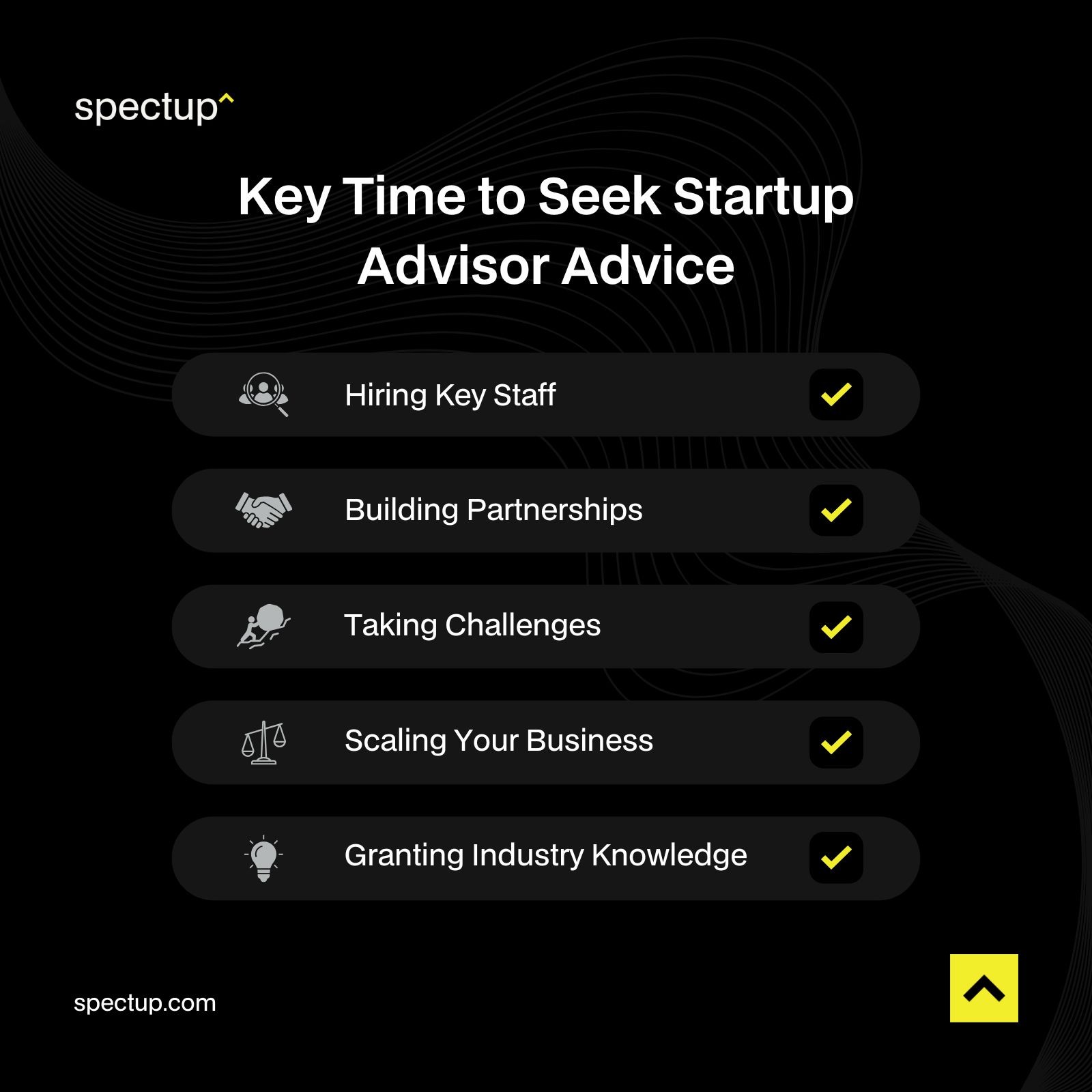

When Do You Need a Startup Advisor?

A startup advisor can make or break your journey. From hiring to scaling, their valuable insights can guide you. By choosing the right startup advisor, you get more than just advice—you get a partner on the road to success.

Here are the key times to seek startup advice:

Hiring Key Staff: When you're ready to bring in talent, finding startup advisors helps you build a strong team. In the startup world, over 80% of businesses fail due to poor recruitment choices.

Building Partnerships: Advisors offer connections, opening doors to key partnerships and collaborations that fuel your startup life.

Tackling Challenges: Startup advisors help solve tricky issues, offering solutions you might not see alone.

Scaling Your Business: If you're ready to grow, recruiting advisors can provide the guidance you need to ramp up sales or enter new markets.

Gaining Industry Knowledge: A right startup advisor fills knowledge gaps and gives credibility to your startup journey.

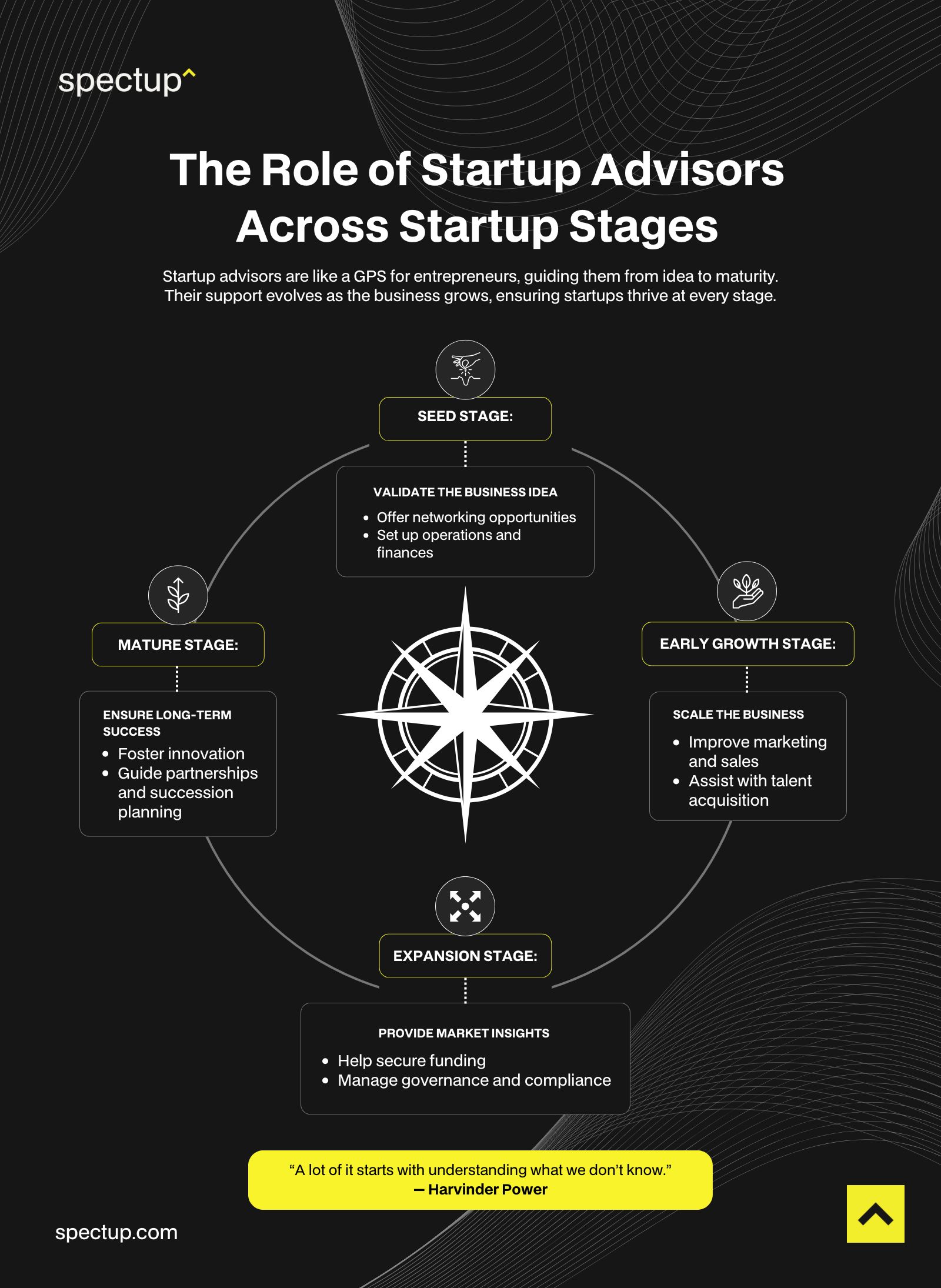

What is the Role of Startup Advisor in Startup Stages?

Startup advisors are like a GPS for entrepreneurs, guiding them through every twist and turn of their startup journey. From early-stage ideas to mature businesses, their business advice can be the difference between success and failure.

“A lot of it starts with understanding what we don’t know,”

Harvinder Power, cofounder and CEO of Motics

Seed Stage

At the seed stage, a business advisor plays a crucial role in shaping the foundation of an early-stage startup. They help validate the business idea, ensuring it's not just a passing thought but a workable concept. Like planting seeds in fertile soil, advisors guide startup founders in fine-tuning the business model and ensuring it fits the market.

Startup advisors also offer essential networking opportunities, helping startups connect with potential investors, partners, and industry experts.

This is important, as 90% of startups fail due to poor networking and lack of financial backing.

Moreover, these advisors focus on business strategy. They guide founders on how to set up operations, plan finances, and handle the challenges that pop up early in the game. Their support helps keep startups on the right track from day one.

Early Growth Stage

Once the startup grows, the advisor's role shifts toward scaling. It's like upgrading your bike for a faster ride. Advisors help with marketing, sales, and finding more customers. They also focus on operational efficiency, allowing the startup to run like a well-oiled machine.

Hiring the right people is another big task at this stage. Advisors lend a hand in talent acquisition, helping build a solid team to take the business forward. As the saying goes, "A chain is only as strong as its weakest link," and startup advisors help ensure each link in the team is solid.

Expansion Stage

When a startup is ready to expand, advisors help map the path for entering new markets. They provide subject matter expertise on market trends and offer business advice on tackling new segments or regions. Their insights are invaluable when navigating funding rounds or managing finances during expansion.

Advisors also guide startups through complex processes like governance and compliance, helping them stay on the right side of the law while growing.

Mature Stage

At the mature stage, the role of startup advisors is to ensure long-term success. They help businesses keep their competitive edge by fostering innovation and facilitating partnerships, mergers, or acquisitions. Advisors also contribute to succession planning, ensuring that the business keeps thriving even when the founders step back.

By this stage, startup advisory becomes less about immediate actions and more about strategic visioning, setting the company up for long-lasting success.

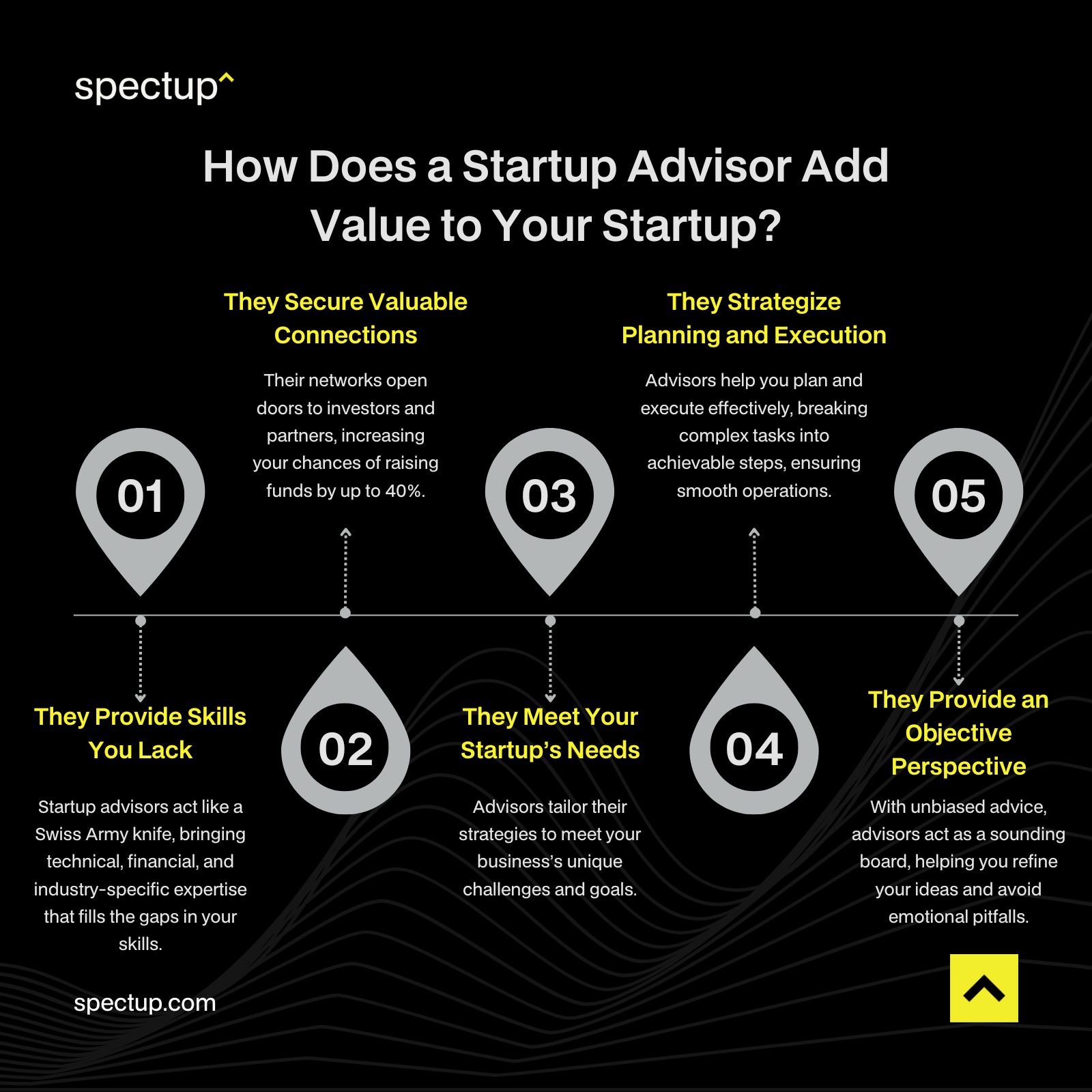

How does a Startup Advisor add Value to Your Startup?

A startup advisor helps bridge the gap between dreams and reality. With their subject matter expertise and proven track record, they bring skills, connections, and strategic advice that startups need to thrive.

They Provide Skills You Lack

Think of a startup advisor as a Swiss Army knife for your business—loaded with tools you may not have. As a startup founder, you might be great at creating a product but lack the technical skills needed for scaling or financial planning.

That’s where advisors shine. They bring deep industry knowledge and subject matter expertise, filling in gaps to make your startup more well-rounded.

For example, advisors with marketing strategy experience can help you create campaigns that attract the right customers, potentially increasing revenue by 30%, according to marketing studies.

They Secure Valuable Connections

In the business world, it's not always what you know but who you know. A startup advisor opens doors you didn’t even know existed. Their strategic alliances and networks can connect you with investors, partners, or potential clients.

Statistically, startups with strong advisor connections are more likely to raise funding successfully—about 40% more, according to startup data.

Advisors also help you build a network that will continue to benefit your business as it grows.

They Meet Your Startup’s Needs

Every startup is different, and a good advisor knows how to tailor their advice to meet your needs. Whether developing a strategic plan for the next five years or helping with day-to-day challenges, advisors provide guidance that aligns with your goals.

Think of them as a GPS for your startup journey—guiding you in the right direction when things get complicated.

Successful startups often credit their advisors for steering them away from costly mistakes and toward better opportunities.

They Strategize Planning and Execution

A startup without a plan is like a ship without a compass—it might move, but it's not going anywhere fast. Advisors help create and strategize planning that aligns with your business goals. They don’t just plan; they help execute as well.

By breaking down complex steps into actionable tasks, they ensure smooth operations. Advisors also bring efficiency to execution, assisting startups to avoid common pitfalls that cause delays.

They Provide an Objective Perspective

It’s easy to get emotionally attached to your startup. An advisor provides an objective perspective, giving you unbiased feedback. They act as a sounding board, offering strategic advice without emotional bias.

This is crucial because startup founders sometimes get too close to their business to see flaws. An advisor brings clarity and helps refine ideas, keeping the startup on a clear path toward success.

What to Look for in a Startup Advisor

Choosing the right startup advisor is like finding a co-pilot for your business journey. Here's what to keep an eye on:

“Super knowledgeable subject-matter experts with a good attitude. It ultimately comes down to trust,” says Sihvonen. “Being able to see an advisor have contributions over a long time frame… We value people who think about the company in the long–term as well.”

Sam Sihvonen, Cofounder and CEO of Solu

Deep Industry Knowledge

Your advisor should know their industry inside out. They need to fill gaps in your knowledge and offer insights that help your business grow. According to CB Insights, 42% of startups fail due to lacking market need, so having a knowledgeable advisor is key.

Strong Reputation

Check their track record! Have they guided successful startups before? Referrals and past successes speak louder than words. After all, you want someone with experience and credibility.

Communication Skills

An advisor who listens well and explains complex ideas is a real gem. You need someone who makes sure you're on the same page.

Willingness to Challenge You

A good advisor will push you out of your comfort zone. They’ll challenge your ideas and help you grow, not just tell you what you want to hear.

Availability

Lastly, make sure they’re available. You don’t want someone who’s always too busy to lend a hand when you need guidance.

Where Can You Find a Startup Advisor?

Finding a startup advisor is about knowing where to look and seizing the right opportunities. With the right approach, your advisor could be the missing puzzle to your startup's success.

“I usually look within my network, see how far away we are on LinkedIn and try and see if I can get someone to do an intro, and if not, I usually just message them. And 90%+ answer and take the time, which is amazing, but I think it has more to do with the cause — trying to do something to help women — than me personally.”

Astrid Kristensen, cofounder and CEO of LEIA

Startup Networking Events

If you want to meet advisors, networking opportunities, demo days, meetups, and startup groups are your goldmine. These events are packed with investors and advisors eager to hear new ideas. Plus, if you're in a niche industry, you’ll find industry experts who bring valuable insights to your startup journey.

A study shows that 80% of entrepreneurs who attend these events gain vital contacts, which can be game-changing for early-stage startups.

Partners

Sometimes, your best advisor might be right under your nose—a business partner, customer, or supplier. Working closely with key players often leads to valuable contacts who can offer advice or become investors.

Take Uber, for example. Founder Travis Kalanick’s discussions with the Taxi & Limousine Commission helped Uber gain 73% of New York City's ride-hailing market by 2019.

These informal chats sometimes lead to formal startup advisory board roles later.

Cold Emailing Startup Advisors

Sending a cold email is like fishing—you never know if you’ll get a bite, but it can be huge when you do. The trick is mastering the art of cold emailing startup advisors. Personalize your message, be direct, and avoid automation.

According to studies, only 24% of cold emails are opened, but a well-crafted one could unlock doors to seasoned advisors across the globe.

Online Communities

In today’s digital age, you can find startup advisors in online communities without leaving your desk. Platforms like IndieHackers or Startup School are great places to network with like-minded entrepreneurs and industry experts. Here, people are eager to share knowledge, making it easier to form long-lasting relationships.

Research shows that 64% of startup founders in online communities find long-term business allies.

Mentorship Platforms

If you’re looking for a quicker route, mentorship platforms like GrowthMentor offer instant access to subject matter experts.

Whether you need guidance on financial planning or help with scaling, you can book sessions with advisors who fit your needs. These platforms are rising in popularity because they make it easy to connect with advisors with a proven track record of helping startups succeed.

How to Get the Most Out of Your Startup Advisor?

A great startup advisor can be the secret sauce to your company’s success, helping you solve problems and scale faster. But how do you make the most of their wisdom?

With the right strategy, your startup advisor can be a game-changer in your business journey, guiding you toward growth and success.

"Successful startups know that the right advisor can unlock doors to opportunities and guide them through challenges."

Entrepreneur Magazine

Pick the Right Advisors for Your Startup

Choosing the right advisors is like picking a toolkit—you need the right tools for the job. Look for advisors who not only have industry knowledge but can also offer expertise in areas like content marketing, operational efficiency, and exit strategies.

Studies show that 70% of startups with experienced advisors perform better than those without. You might need more advisors if your startup covers different fields. Finding someone who complements your strengths and fills in the gaps is key.

Know When You Need Advising

Timing is everything. Whether drafting business plans, setting up exit strategies, or trying to boost operational efficiency, knowing when to reach out for help is crucial.

Early on, advisors can offer valuable input that shapes your company’s success, while later stages might need specialized advice, like navigating angel investors.

Ignore the 80-20 Advising Rule

The classic saying goes, "80% of advice comes from 20% of advisors." But in reality, every piece of advice can be golden if applied correctly.

Whether they’re helping you with valuable introductions offering insights on just about any area, don’t dismiss someone’s advice because they aren’t your “main” advisor. Every advisor brings something to the table that can help you see the bigger picture.

Cultivate a Strong Relationship

Your advising relationship is like a two-way street. Communicate effectively, be transparent about your struggles, and ensure your advisors feel valued.

A study found that 88% of founders with strong advisor relationships felt more confident in their decision-making. When the lines of communication are open, advisors are more likely to go the extra mile, like lending credibility to your startup when talking to investors.

Continuously Evaluate and Update

As your startup grows, your needs will evolve. Don’t be afraid to evaluate your advisory team regularly. What worked for your company during its early days might not be as effective later. Some advisors are great for specific phases, but you may need to bring in others for new challenges.

Statistics show that startups that consistently update their advisors are 30% more likely to secure funding rounds.

How to Pay a Startup Advisor

Paying a startup advisor isn’t as simple as handing them a paycheck. They bring valuable experience, so compensating them fairly is essential for long-term success. Here’s how to do it.

"Good pay for a startup advisor reflects the value they bring, turning their expertise into your business success."

Forbes

Hourly Rate or Meeting Fee

Think of paying an advisor like hiring a lawyer or consultant. Depending on their expertise, most advisors charge between $250 to $1,500 per hour.

For example, an advisor specializing in financial planning or strategic advice might fall on the higher end. A good rule of thumb is to divide their monthly salary by 160 and then double it to get a fair hourly rate. Don’t forget, if they travel for meetings, it's common to cover those expenses.

A Monthly or Quarterly Retainer

If your advisor is regularly involved, a retainer is a cost-effective option. This allows you to secure their help for more than a few hours. It’s like a subscription service for expertise. Retainers are often cheaper in the long run because advisors won’t charge for every extra hour worked.

Be sure to set the retainer based on an honest estimate of the needed time. 55% of startups hire advisors on a retainer basis for ongoing support.

Equity Stake

When cash is tight, many startups offer equity stakes instead of payments. On average, advisors receive 1.5% to 2.5% equity, but this can go as high as 5% for advisors with significant experience or “star potential.”

Advisors’ equity typically follows a vesting schedule, ensuring they receive shares over time. This keeps them motivated and protects the startup if the advisor stops adding value early on.

Equity and Cash Mix

You can mix it up by offering a blend of equity and cash. For example, an advisor could accept a lower equity stake and a reduced hourly fee. This hybrid model can also include cash payments for any work beyond the agreed hours in the retainer.

Like with employees, it’s crucial to tie compensation to milestones within the advisor's control, like securing strategic alliances or organizing key meetings.

What Should You Cover in Your Advisory Agreement?

Getting an advisory agreement is like laying the foundation for a strong relationship with your startup advisor.

"An advisory agreement ensures clear expectations, protects both parties, and aligns goals, making it vital for successful partnerships."

Investopedia

Here's what you should make sure to include. Covering these key points will ensure a smooth and mutually beneficial advising relationship!

Responsibilities of the Startup Advisor: It’s crucial to spell out the advisor's duties, from providing strategic advice to connecting you with key players. Be clear on what they won’t do, too. This avoids misunderstandings down the road. Think of it like drawing a roadmap—everyone needs to know where they’re going!

Confidentiality and Non-Disclosure: Your advisor will have access to your most sensitive information, like your business plans or financials. Ensure they sign a non-disclosure agreement (NDA) to keep everything under wraps. According to SCORE, 65% of startups believe NDAs are crucial for protecting intellectual property.

Compensation and Milestones: Money talks. Set clear terms for how your advisor will be paid, whether through an hourly rate or equity. You should also outline any milestones that trigger payments, ensuring both sides know when to expect what.

Agreement Length and Termination: Nothing lasts forever. Include the length of the agreement and how either party can terminate it if things aren’t working out. This is like having an exit strategy—just in case.

Summing Up

A top-notch startup advisor can significantly boost any startup's success. Your biggest advantage as a startup is speed, and experienced advisors offer you 10,000 hours of expertise in exchange for money or equity, saving you valuable time. Also, ensure to make startup advisory agreement to pay your advisor for providing strategic guidance.

Want to accelerate your startup's growth? spectup offers tailored strategies, mentorship, and essential resources to help you scale effectively and achieve your business goals.

Niclas Schlopsna

Partner

Ex-banker, drove scale at N26, launched new ventures at Deloitte, and built from scratch across three startup ecosystems.